At The Financial Resource Center, we specialize in addressing the unique financial needs of healthcare practitioners and executives. We provide comprehensive financial planning and wealth management services tailored to the complexities of your profession, your success, your income, and your lifestyle. Our goal is to simplify your financial picture and help you make informed decisions that align with your career goals, lifestyle, and legacy.

Our Approach

Our Specialty: Retirement Income Planning

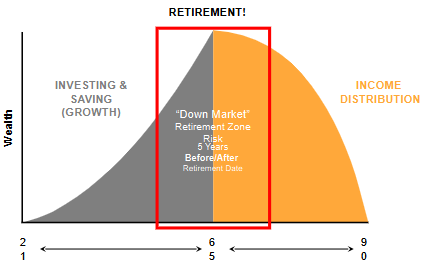

We specialize in guiding clients through the Retirement Red Zone—the crucial five years before and after retirement. This is a time when strategic planning is essential to ensure a smooth and secure transition into retirement. We provide personalized, integrated solutions that align your financial goals with every aspect of your life, from maximizing retirement income and managing taxes to addressing healthcare and estate planning needs. Our comprehensive approach helps protect your wealth, navigate market risks, and create sustainable income, giving you the confidence to enjoy retirement on your terms.